The International Accounting Standards Board (IASB) has introduced IFRS 18 Presentation and Disclosure in Financial Statements, effective from April 9, 2024. This new standard supersedes IFRS 1 Presentation of Financial Statements, addressing investors’ growing demands for enhanced transparency and detailed financial performance reporting.

What are the key changes?

1. More structured income statement

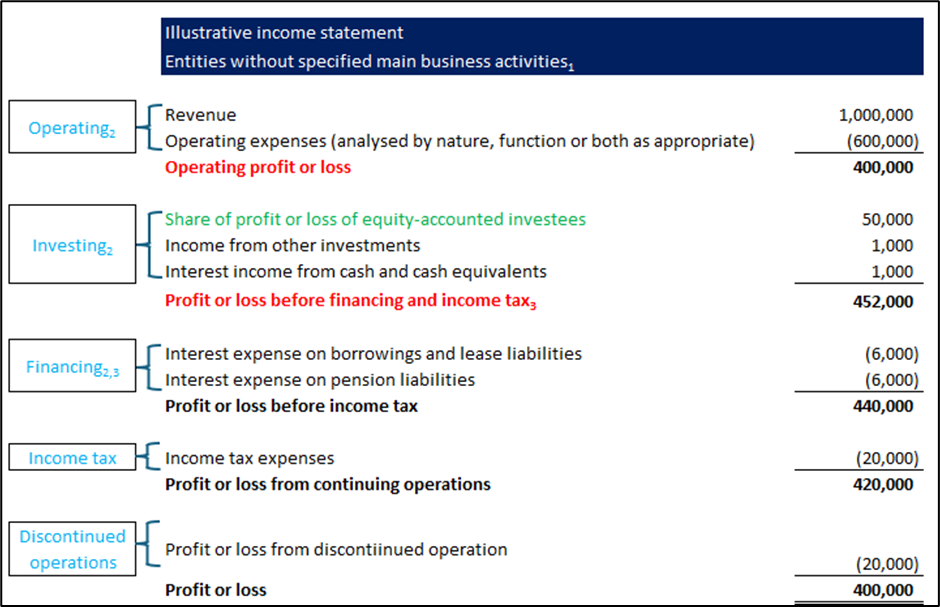

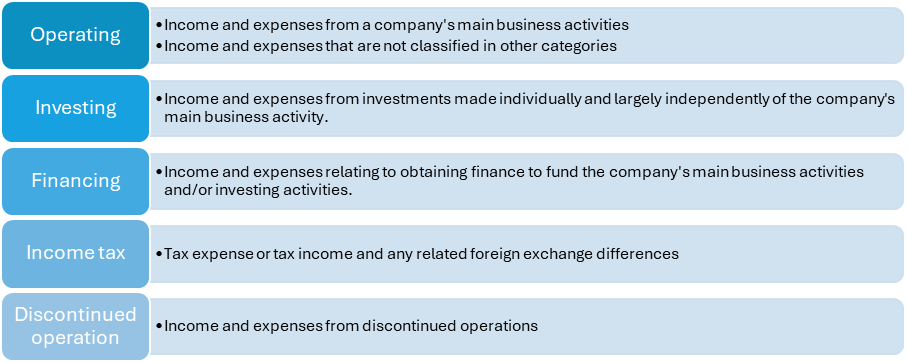

The income statement will now follow a more structured format with five categories for classifying income and expenses:

The chart below provides a further breakdown of each category. Additionally, new definitions for operating profit or loss, profit or loss before financing and income taxes, and other relevant subtotals will be included in the income statement.

Required totals and subtotals

| Required totals and subtotals | Is this new? |

| Operating profit or loss Profit or loss before financing and income taxes | Yes, newly introduced by IFRS 18 |

| Profit or loss Total other comprehensive income Total comprehensive income | No, carried forward from IFRS 1. |

Other additional subtotals

Additional Subtotals: Companies will need to include additional subtotals in the income statement if necessary for providing a structured and useful summary of financial performance. These may include:

- Net interest income

- Net rental income

- Net fee and commission income

- Operating profit or loss before depreciation, amortisation and impairments

- Operating profit or loss, and income and expenses from all investments accounted under equity method

- Profit or loss before income tax

- Profit or loss from continuing operations

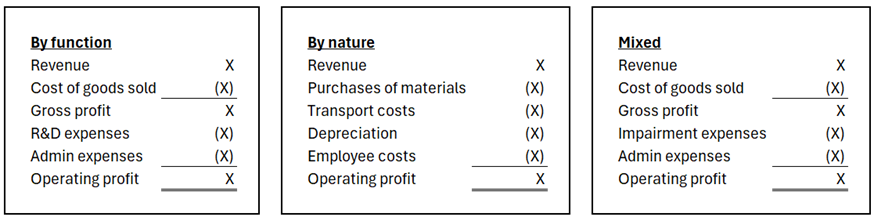

Present operating expenses either by function, by nature or on a mixed basis on the face of the income statement.

Companies can choose to present operating expenses either by function, nature, or a mixed method based on what provides the most useful information. When deciding, consider the following factors:

- Main components or drivers of the company’s profitability

- The way the business is managed and how management reports internally

- Industry practices

- Allocation of expenses to functions

Companies might consider the following factors to determine which method provides the most useful information when analysing operating expenses either by nature, by function, or on a mixed basis.

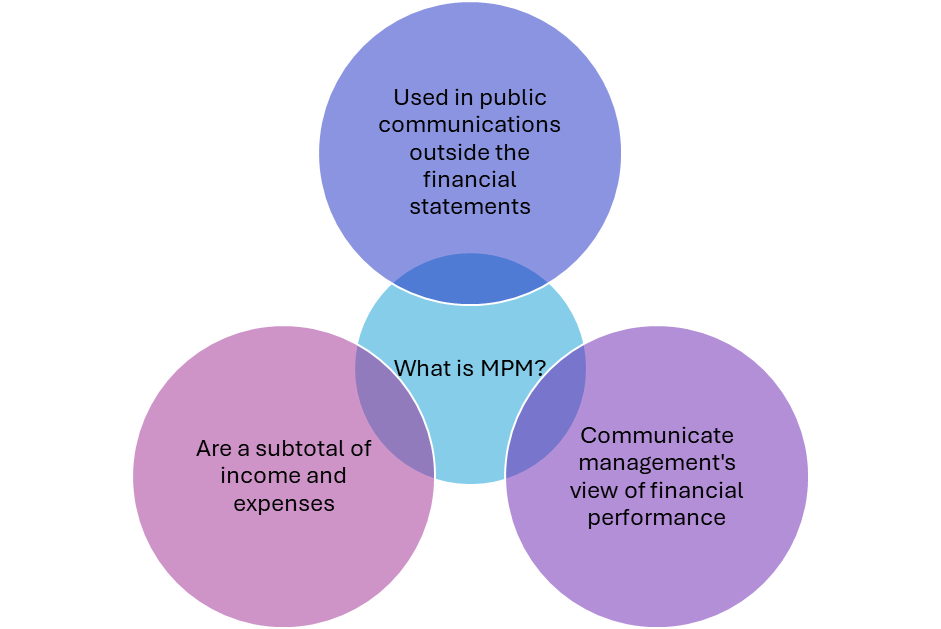

2. Management performance measures (“MPM”)

Companies are required to disclose in a single note in financial statements, that:-

- States MPM provides management’s view of the company’s financial performance and is not necessarily comparable to MPMs of other companies;

- Explains why MPM provides useful information and how it is calculated;

- Reconciles the MPM to a total / subtotal required in IFRS 18 and other accounting standards, including the tax and non-controlling interest effects for each reconciling item; and

- Explains any changes

3. Aggregation and disaggregation

IFRS 18 introduces a defined role for primary financial statements, aimed at providing a clear, structured overview of a company’s financial position. Materiality will continue to guide whether a company must present or disclose information.

Under the new standard, companies should:

- Aggregates assets, liabilities, equity, income, expenses or cash flows into items based on shared characteristics;

- Disaggregates items based on characteristics that are not shared;

- Aggregates or disaggregates items to present line items in the primary financial statements that provide useful structured summaries or disclose material information in the notes; and

- Ensures that aggregation and disaggregation do not obscure material information.

4. Cash flow statement

Under the amended IFRS, operating profit or loss will now be the starting point for presenting operating cash flows using the indirect method.

For companies that do not primarily provide financing or invest in assets, the classification of interest and dividends will be:

- The interest and dividend received are classified under investing activities under the amended IFRS.

- The interest and dividend paid are classified under financing activities under the amended IFRS.

For companies that provide financing to customers or invest in assets as main business activity,

- The interest paid and received, and dividend received are classified under the same category as classified in income statements.

- The dividend paid is classified under financing activity.

5. Balance Sheet

A new requirement under IFRS 18 mandates that goodwill be presented as a separate line item on the balance sheet.

What should companies do now?

IFRS 18 is effective from 1 January 2027 and applies retrospectively. Early adoption is permitted. Now is the time to get ready.

- Assess the impacts on your financial statements

- Communicate the impacts with investors

- Consider how the new requirements impact financial reporting systems and processes.

- Monitor any changes in the local reporting landscape.

If you have any questions, please email to:-

Funds-related inquiries

Jocelyn <jocelyn@prestigefiduciary.com>

Zoey <zoey@prestigefiduciary.com>

Shi Ning <shining@prestigefiduciary.com>

Sales inquiries

Dong Neng <dongneng@prestigefiduciary.com>

Xiao Yan <xiaoyan@vodich.com.sg>

Clarissa <sales@vodich.com.sg>

Tax inquiries

Siew Chui <susan@vodich.com.sg>

General inquiries

Puay Siang <puaysiang@vodich.com.sg>